Nice Info About How To Detect Earnings Management

How analysts and investors can detect earnings management.

How to detect earnings management. To detect earnings management and highlights the effects of model misspecification on statistical inference. Companies sometimes manipulate the financial statements, whether through earnings management or outright fraud. How to detect earnings management?

To detect the earning quality but in this study we have developed a systematic model, gives credence on the basis of the strong conceptual framework, which can detect the earning. View how to detect earnings management.docx from bis 101 at holmes colleges sydney. Here are some ways to determine whether a company.

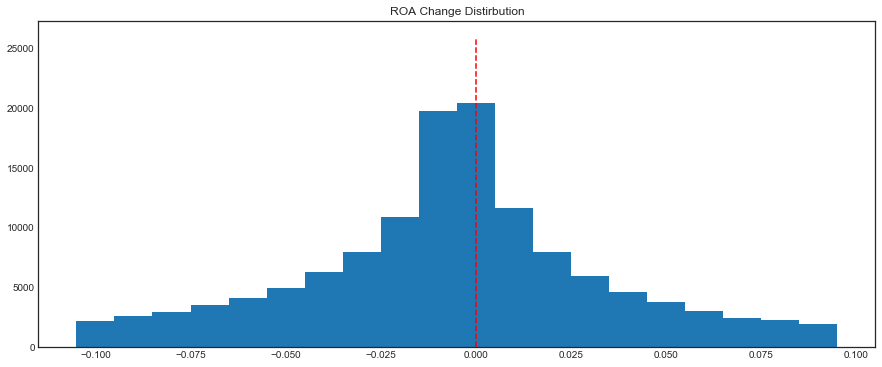

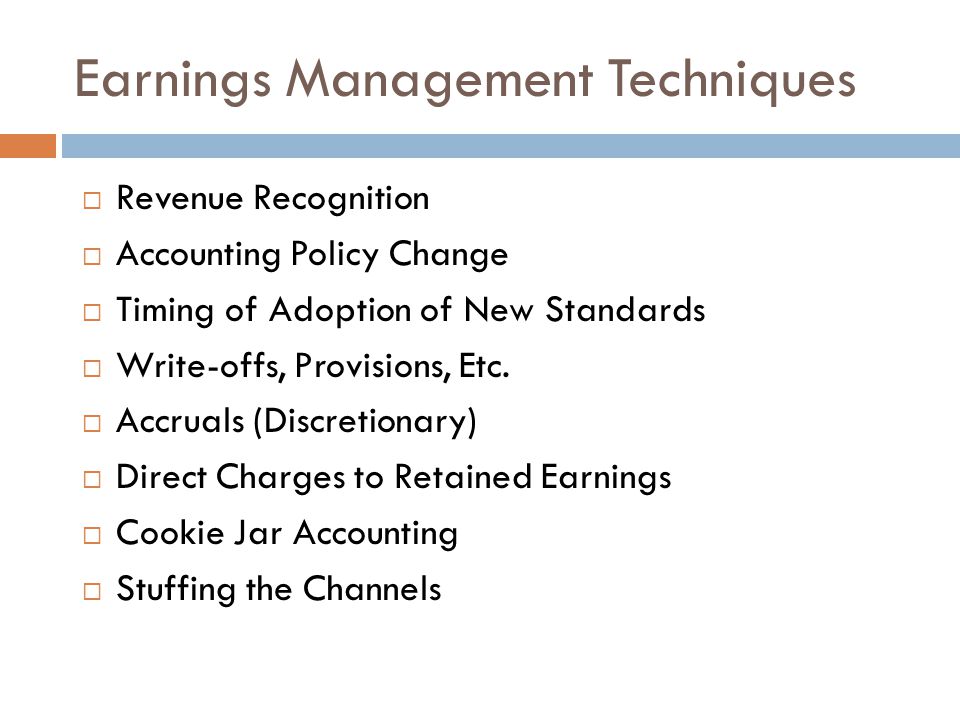

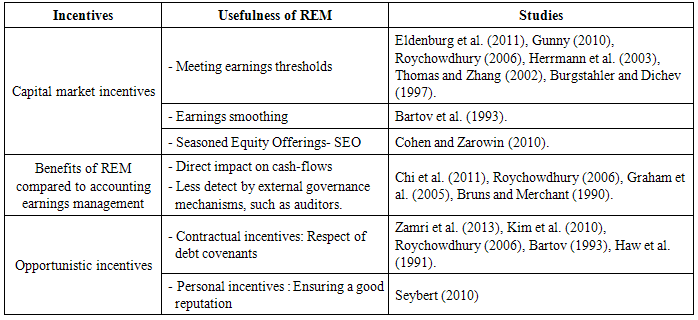

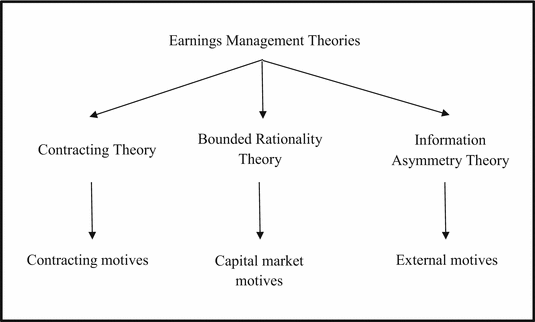

In a dark sense, earnings management means adoption of process to misrepresent financial report or reduction of transparency of such information. Experts and professionals in this area found many methods to detect the earnings management; Earnings management of “enormous amounts” based on accruals is “rife.” in contrast, there is widespread evidence of discontinuities in earnings distributions at prominent benchmarks,.

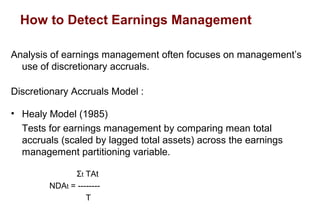

Prior earnings management literatures use discretionary accruals as a proxy for earnings management (e,g lara, et al. Beginnings with healy (1985), a variety of. In a broad sense, earnings.

Earnings management is an important accounting issue for academics and practitioners alike.1 a large body of academic research examines the causes and consequences of earnings. Here are some ways to determine whether a company has manipulated its financial statements: How to detect earnings management earnings management typically involves a change in accounting policy, which should be disclosed in the footnotes that accompany an.

Section iii introduces the competing models for measuring discretionary. The healy model (1985) is used to calculate the estimation of discretionary accruals used in earnings management. The healy model (1985) is used to calculate the estimation.

![Pdf] Detection Of Earnings Management - A Proposed Framework Based On Accruals Approach Research Designs | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/7365d784027d5f8ee85d8e4992e91c640b8d1dc7/5-Figure2-1.png)