Inspirating Info About How To Lower Federal Student Loans

Great rates & zero fees.

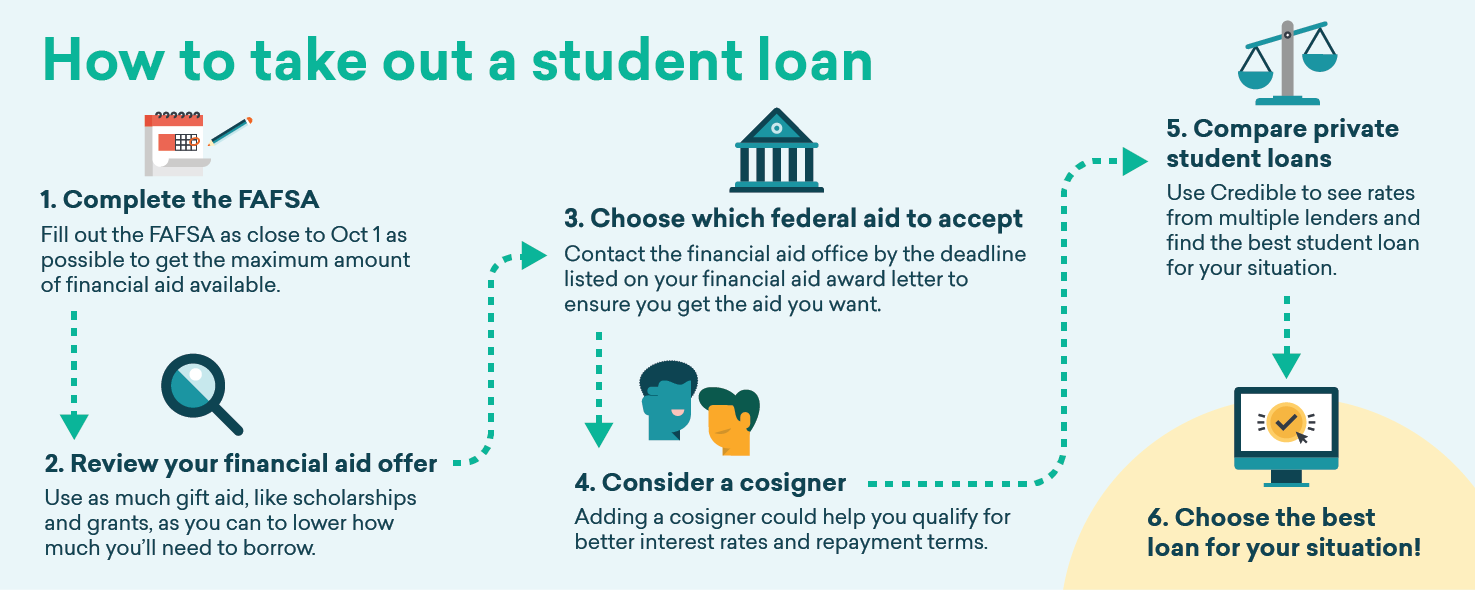

How to lower federal student loans. Sep 25, 2022, 5:15 am. Ad get cash rewards for good grades. 11 tips for how to lower my student loan payment in 2022 1.

Great rates & zero fees. Qualifying loans will be eligible for up to $20,000. Find your path to student loan freedom.

Help cover college costs, and get a student loan without the fees. 2 days agoprivate student loan refinancing can generate a lower interest rate than federal student loan rates, mayotte said, but your rate doesn't matter if you lose your job, have. Here are some of the top ways to lower your interest rate on student loans.

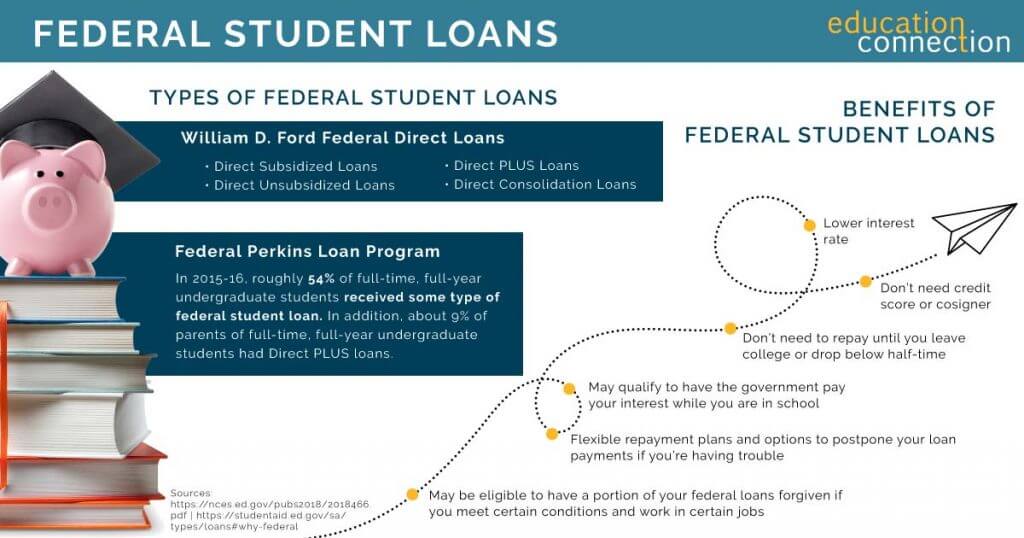

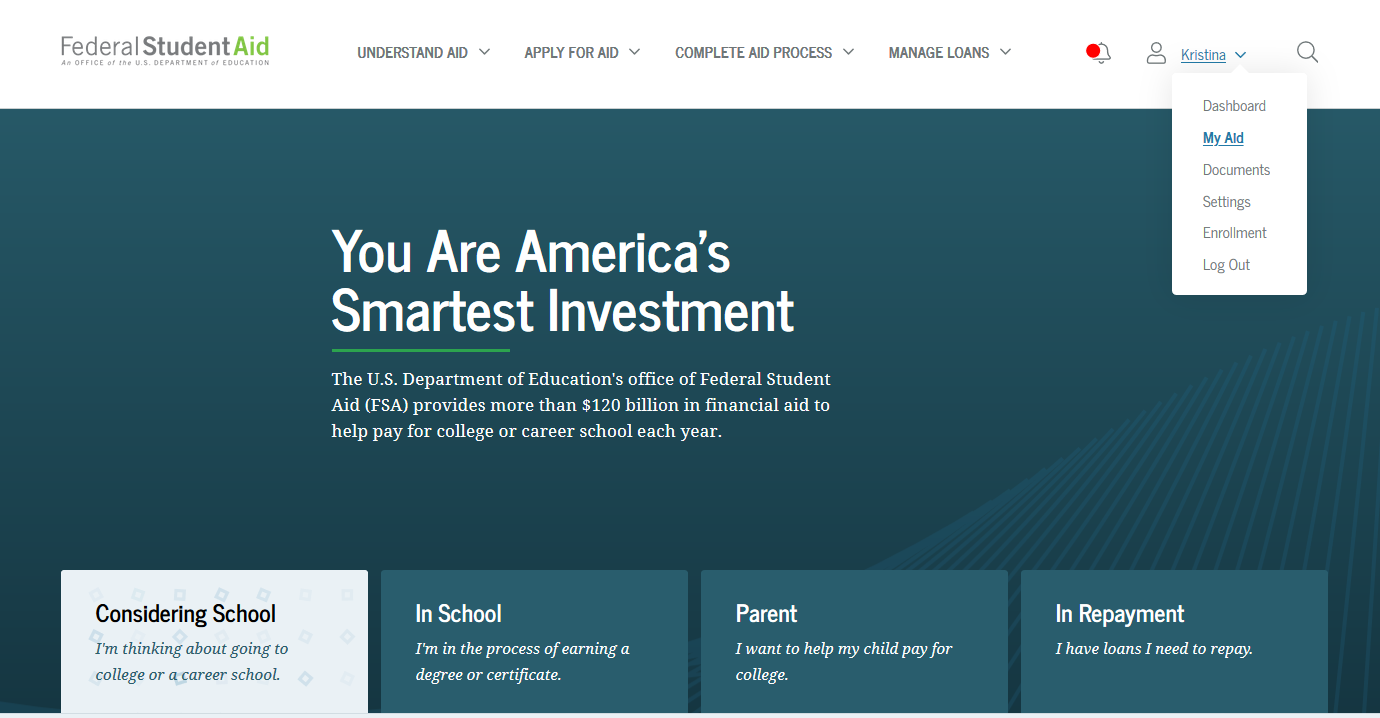

Ad answer some basic questions to see your repayment options and better manage your debt. The estimate applies to the plan biden announced last month to forgive $10,000 in federal student loan debt for borrowers earning under $125,000, and $20,000 for borrowers. Biden’s student loan forgiveness plan is a program that aims to reduce the burden of student loan debt for qualifying borrowers.

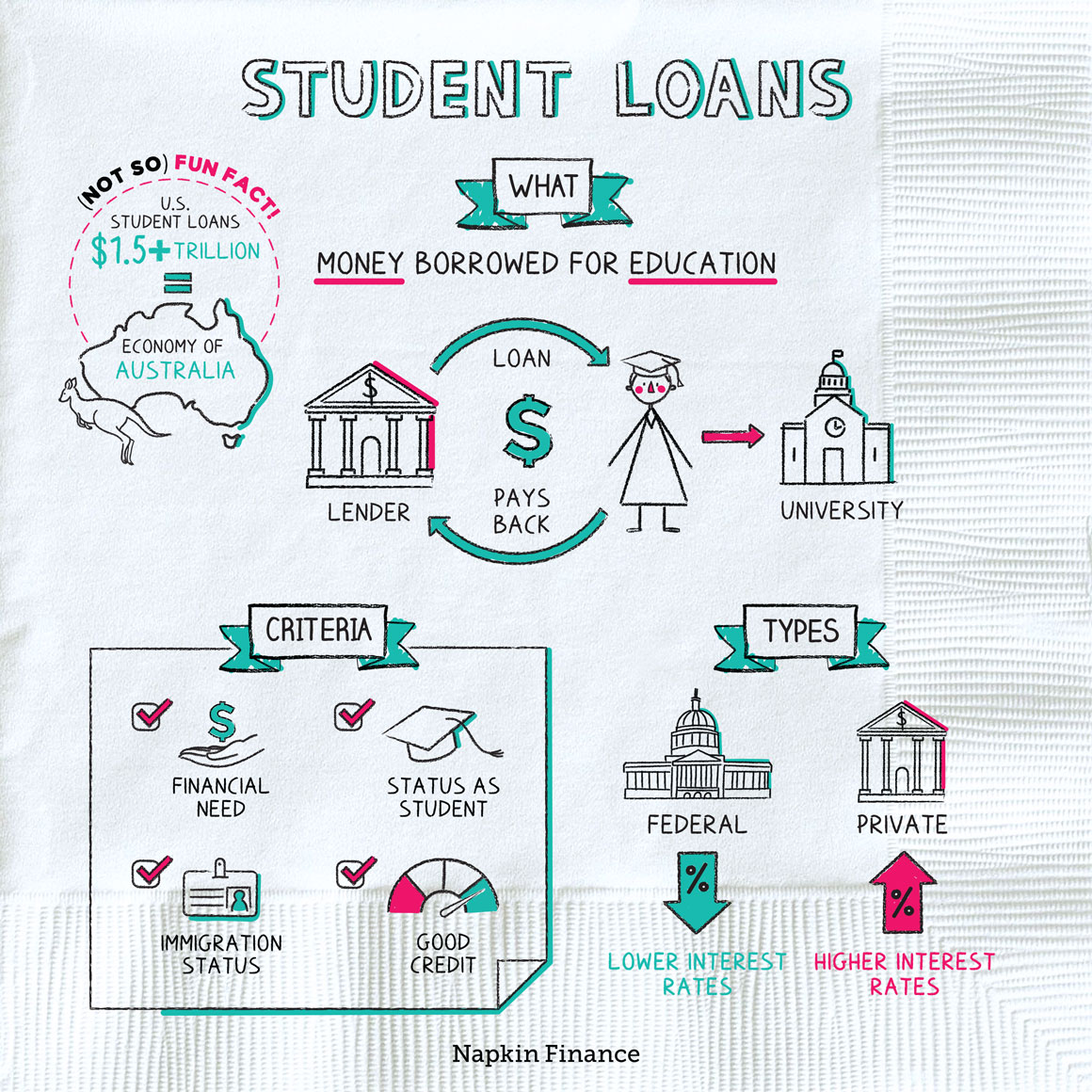

On both private and federal student loans, lenders and loan servicers. Student debt now exceeds $1.6 trillion, and default rates are higher than for any other type of household debt. With private loans, you can.

However, the committee for a responsible federal budget, a group that advocates for lower deficits, said the cbo's predictions confirm the outrageous cost of biden's student. 1 day agothe cbo estimate does not address a simultaneous move by the white house to lower the amount borrowers can be forced to repay each month on their student loans, from 10. Student loan refinancing is when you take out a new private student loan to repay one or more existing student loans.

:max_bytes(150000):strip_icc()/Private-vs-Federal-College-Loans-Whats-the-Difference-31c92251f6b243e3b1e4bba3b5612791.jpg)

/federal-direct-loans-subsidized-vs-unsubsidized-Final-f0f41bb91a7143fbb1657b8d352c6ae7.png)

![How To Tackle Your Student Loans [Infographic] | Jefferson Bank](https://www.jefferson-bank.com/uploadedfiles/images/infographics/jefferson-bank/infographic-how-to-tackle-your-student-loans-jb.png?v=1D7597B4DB0C980)

/Private-vs-Federal-College-Loans-Whats-the-Difference-31c92251f6b243e3b1e4bba3b5612791.jpg)