Fabulous Info About How To Deal With Petty Cash

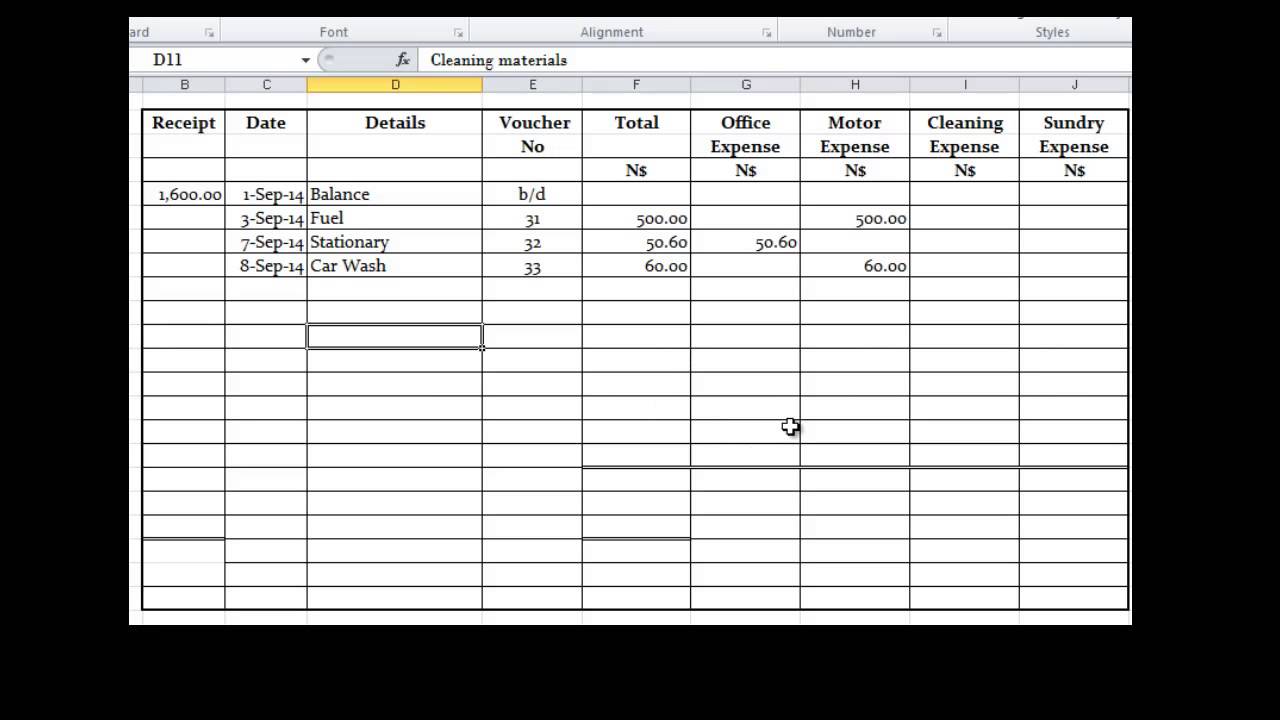

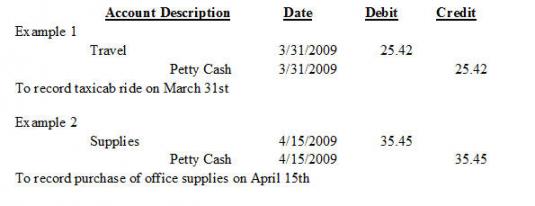

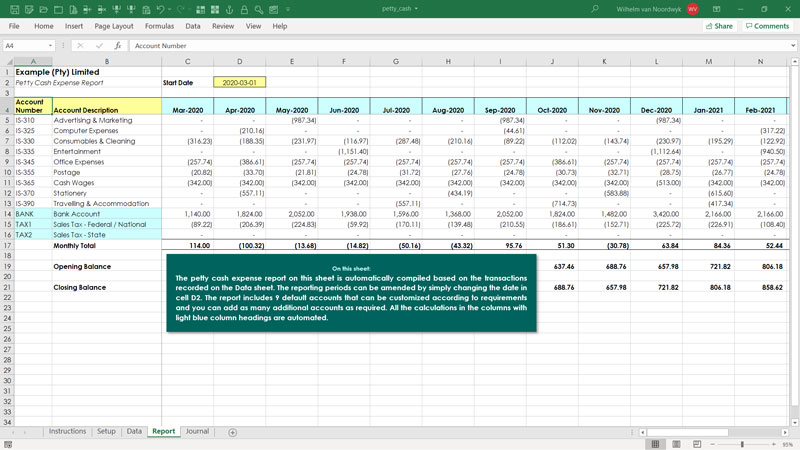

By setting up a petty cash account in the general ledger, keeping receipts for every expense, and balancing journal entries, you’ll be better able to manage business cash flow.

How to deal with petty cash. You may also put a limit, such as $25, on all petty cash transactions. Before you start a petty cash fund, you’ll need to decide how much you want the fund to be. Petty cash, as the name suggests, is a small amount stored in office boxes or drawers to be used to pay for small expenses, including employee meals and snacks.

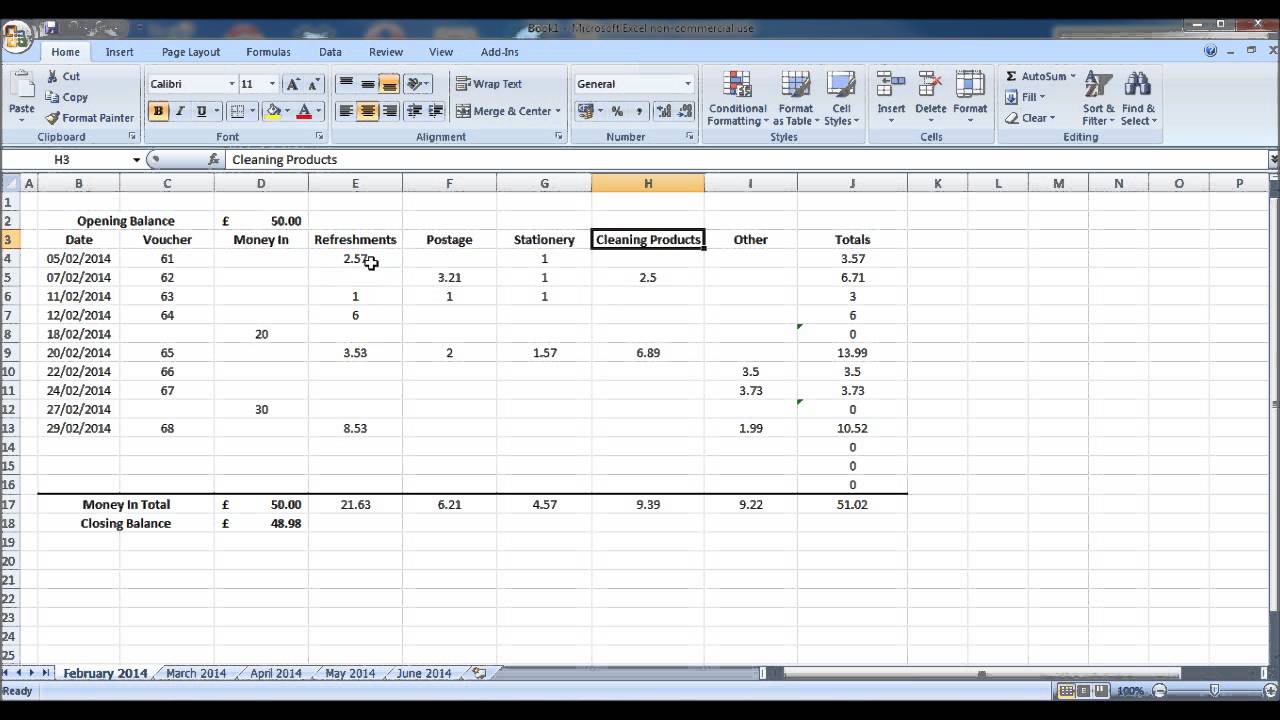

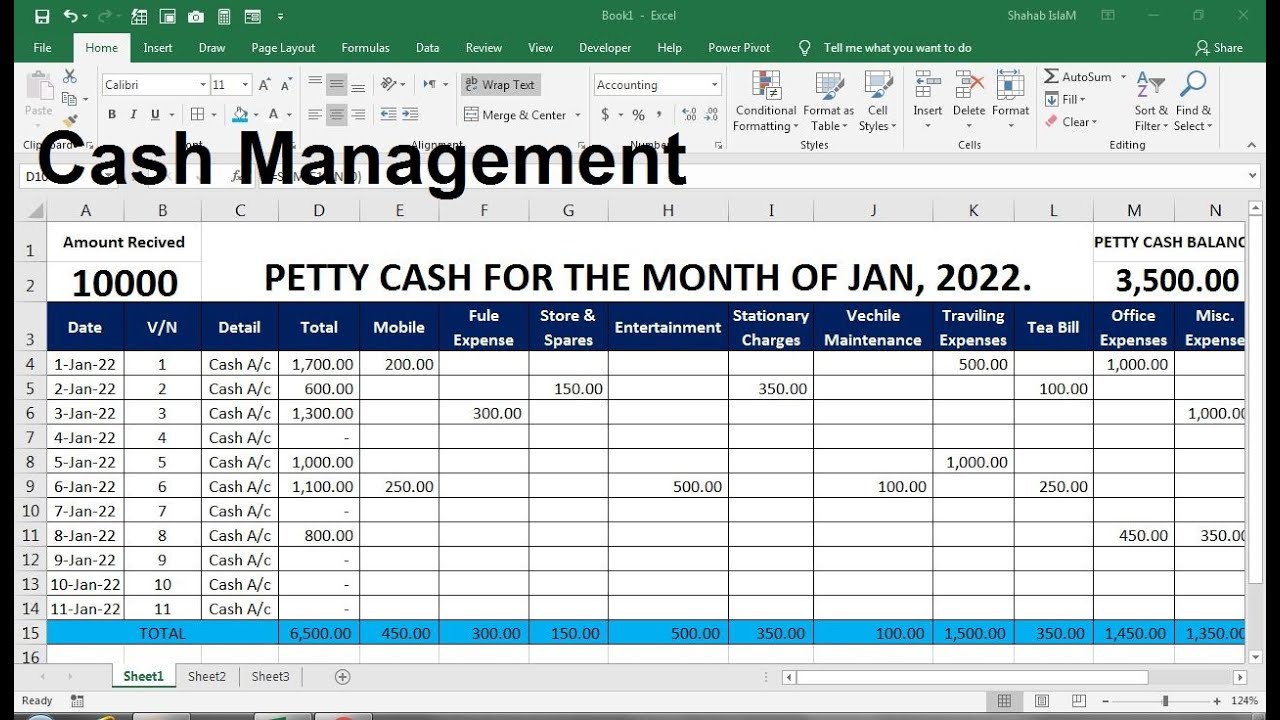

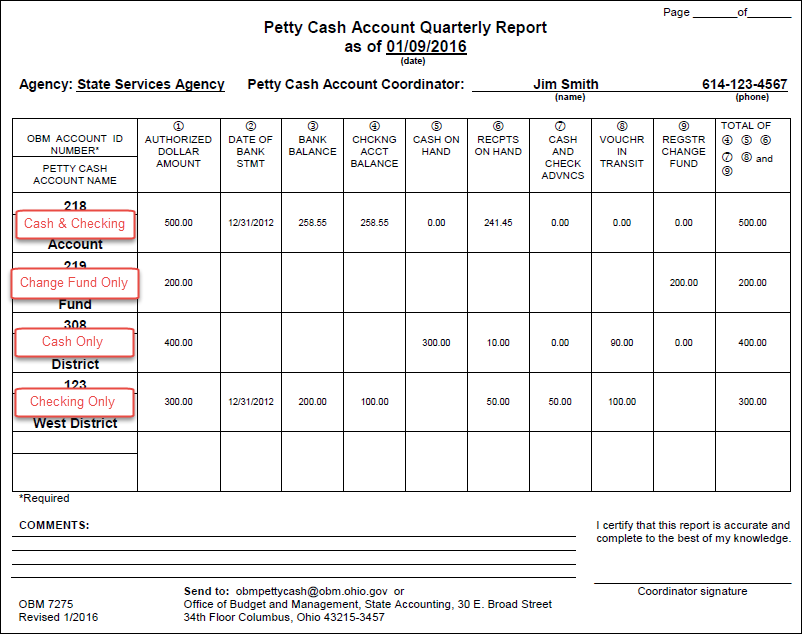

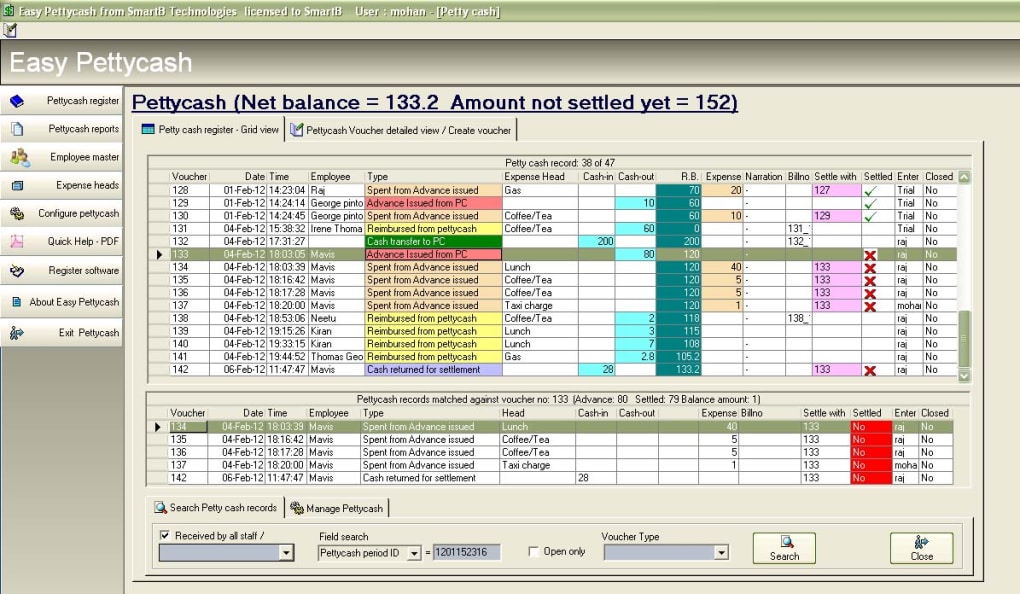

Decide on a float and when to replenish the first step is to define how. Choose cash from the bank option, leave all selected under cashed date and click view. Petty cash transactions are logged alongside other expense accounts in real time.

How to set up a petty cash management system appoint someone as petty cash custodian. Digital management tools mean there’s no longer any need for businesses to still be operating misfiring petty cash systems. The petty cash account can be viewed by running an accounts/any bank report.

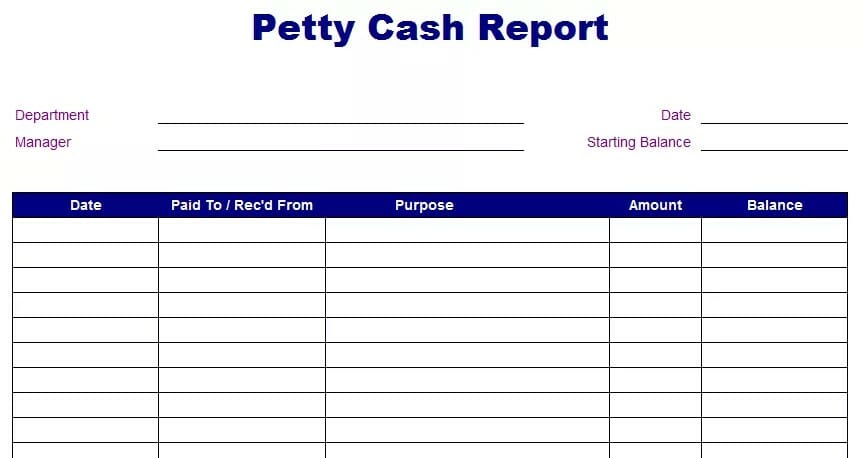

Create ingoing and outgoing cash order documents with the following specifications:. Assign a gatekeeper for the petty cash tin. The petty cash management feature enables you to:

The sum of the receipts and. Don’t keep your petty cash and receipts in your wallet, an envelope and a cash bag, this is how things get lost, keep it all in one location. Ascertain the stated balance review the company’s petty cash policy and determine the stated petty cash balance for the fund to be reviewed.

The general aim is for them to operate independently, with minimal oversight necessary. The most common accountancy approach used to manage petty cash is the ‘imprest’ system. Only one person at a time should be given responsible for the fund.