Exemplary Tips About How To Become A Loan Modification Officer

On average it takes a couple months to become a licensed loan officer, you will need will need to take mandatory education classes, pass examinations and have credit scores and.

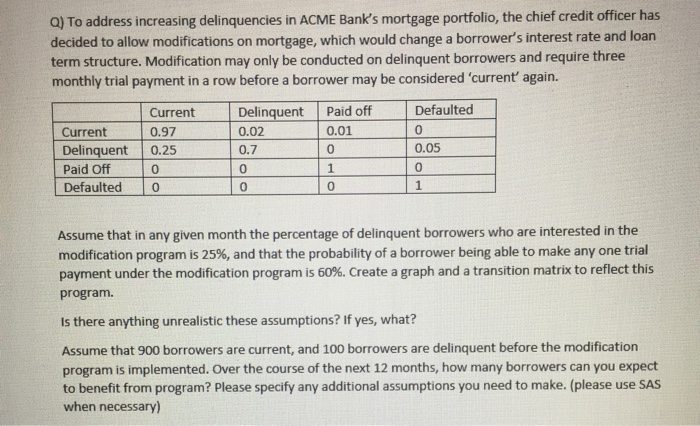

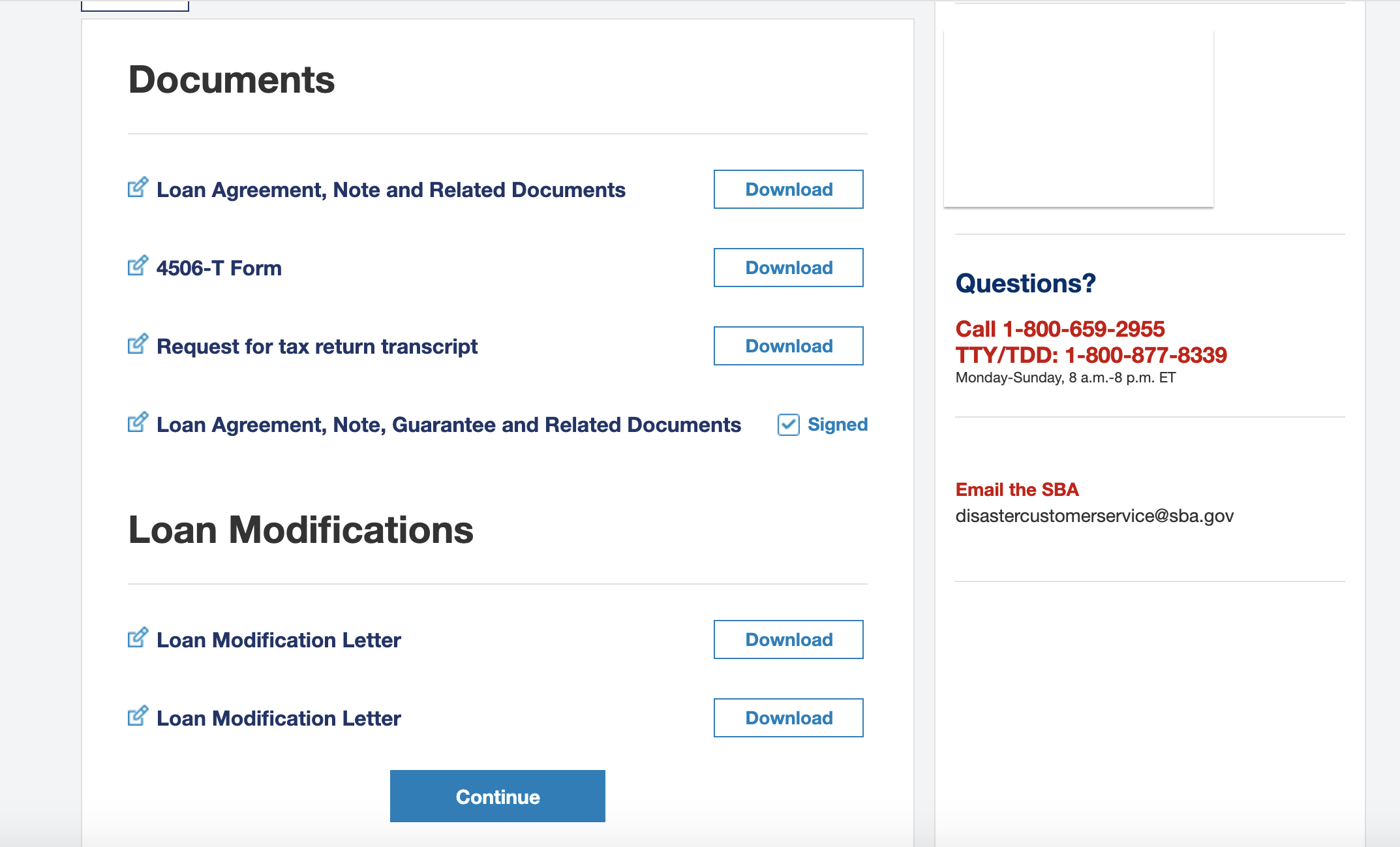

How to become a loan modification officer. Mortgage loan officers must be licensed. This is one of the easiest lice. Below is a break down of sections that must be covered in continuing.

Certification is granted after successful completion of an exam that covers loan modification. Mortgage loan originator licensees must complete eight (8) credit hours of continuing education annually beginning in 2010. Submit the mu4 form through the nmls.

Some banks and mortgage companies require loan officers to hold a bachelor’s degree, so it can about four years to qualify for these jobs. In this video, we are going over the entire process of getting your mortgage loan license to work as a loan originator (mlo)! Gca mortgage | mortgage experts with no overlays

Loan officers typically need a bachelor’s degree,. Step #1 create an account and register with nationwide multistate licensing system & registry ( nmls) and obtain an id number. This is usually in finance or business.

Currently there are no college courses specifically designed for loan modification; The mortgage loan originator licensing act provides for the licensing and regulation of individuals originating mortgage loans in the state of michigan. Approved continuing education providers and their courses will be.

Get the required experience as most employers prefer a candidate with previous experience as loan officers. How to become a loan officer step 1: If you work for yourself or any organization other than an insured depository, then yes, you need to get a mortgage license to become a mortgage loan officer.